AI, SMS, and Debt Collection

In an era dominated by technological advancements, it comes as no surprise that artificial intelligence (AI) is revolutionizing various industries, including debt collection. Traditional debt collection methods have often been associated with inefficiencies and poor customer experiences. However, with the integration of AI and SMS (Short Message Service), a new and improved debt collection strategy is emerging, offering more effective and personalized approaches. In this article, we will explore how AI and SMS are driving innovation in debt collection, revolutionizing the industry for the better.

The Role of SMS in Debt Collection

SMS (Short Message Service) has emerged as a highly effective communication tool in debt collection. Its instant and convenient nature allows debt collectors to reach debtors directly and promptly, bypassing the limitations of traditional communication methods. Debtors tend to carry their mobile phones with them at all times, ensuring that SMS messages are quickly received and read.

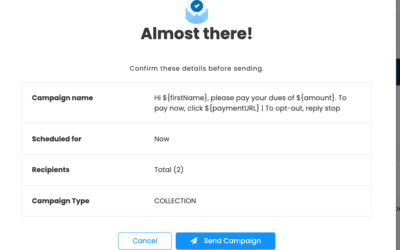

This immediacy enables debt collectors to send timely payment reminders, notifications of upcoming deadlines, or even convenient payment options, encouraging debtors to take immediate action. The personalized and targeted nature of SMS also plays a significant role in debt collection. By integrating AI algorithms with SMS platforms, debt collectors can automate the process of creating and sending personalized messages.

These messages can be tailored to individual debtors, taking into account their payment history, outstanding balances, and preferred communication preferences. By providing debtors with relevant and customized information, debt collectors can significantly enhance the chances of successful debt recovery. Additionally, the interactive and two-way communication feature of SMS allows debtors to respond directly to SMS messages, facilitating real-time feedback, inquiries, or negotiations.

This open line of communication fosters transparency and trust between debt collectors and debtors, leading to improved debtor satisfaction and increased payment compliance.

Furthermore, the automation capabilities of AI and SMS integration streamline routine communications, enabling debt collectors to focus on more critical tasks and improving the overall efficiency of debt collection operations. The power of SMS in debt collection lies in its ability to provide instant, personalized, and interactive communication, enhancing the overall effectiveness of debt collection strategies.

Try Our Premium SMS Platform for Free!

Ready to take advantage of the many benefits that SMS (text messaging) has to offer?

Sign up for our 14-day free trial today to start boosting engagement, increasing open-rates, and making sales. Do more with CloudContactAI.

AI Powered Debt Collection Strategy

Debt collection is a delicate process that requires tactful and efficient communication to encourage debtors to fulfill their obligations. AI has emerged as a game-changer in this field by offering smarter and more data-driven debt collection strategies.

One of the key advantages of AI in debt collection is its ability to analyze vast amounts of data and identify patterns. By leveraging machine learning algorithms, AI systems can examine historical debtor behavior, payment patterns, and other relevant information to create personalized debt collection approaches. This enables debt collectors to tailor their interactions and offers to individual debtors, increasing the chances of successful debt recovery.

Furthermore, AI-powered chatbots are transforming the way debt collection agencies interact with debtors. These chatbots can handle routine inquiries, provide payment reminders, and even negotiate repayment plans, all while offering a seamless customer experience. By automating these tasks, debt collectors can focus on more complex cases, improving efficiency and overall collection rates.

Benefits of SMS for Debt Collection

Among the various communication channels available, SMS has proven to be among the most powerful in debt collection. With its high open and response rates, SMS offers a direct and effective means of reaching debtors. Debt collection agencies are increasingly adopting SMS as part of their strategies, enabling them to connect with debtors promptly and efficiently.

Instant and Convenient Communication:

SMS allows debt collectors to reach debtors instantly, bypassing the barriers of traditional communication methods. Most people carry their mobile phones with them at all times, ensuring that SMS messages are promptly received and read. Debt collectors can leverage this immediacy to send payment reminders, notify debtors of upcoming deadlines, or offer convenient payment options. The convenience of SMS helps keep debtors engaged and encourages timely responses, facilitating quicker debt resolution.

Personalized and Targeted Messaging:

SMS also allows for personalized and targeted messaging, tailoring the content to each debtor’s specific situation. By integrating AI algorithms with SMS platforms, debt collectors can automate the process of creating and sending personalized messages. These messages can take into account factors such as the debtor’s payment history, outstanding balance, and preferred communication preferences. By providing debtors with relevant and customized information, debt collectors can enhance the chances of successful debt recovery.

Interactive and Two-Way Communication:

Unlike traditional debt collection methods, SMS offers a more interactive and two-way communication channel. Debtors can respond directly to SMS messages, allowing for immediate feedback or inquiries. Debt collectors can utilize this feature to address debtor concerns, negotiate repayment plans, or provide additional information. This real-time communication fosters a sense of transparency and trust between debt collectors and debtors, leading to improved debtor satisfaction and increased payment compliance.

Automation and Efficiency:

Integrating AI with SMS platforms enables automation and efficiency in debt collection processes. AI-powered systems can automatically send SMS reminders, follow-ups, and payment notifications based on predefined triggers and schedules. This automation reduces the burden on debt collectors, allowing them to focus on more critical tasks, such as negotiating settlements or handling complex cases. By streamlining routine communications, AI and SMS combination enhance the overall efficiency of debt collection operations.

The Future of Debt Collection, SMS, and AI

The combination of artificial intelligence and SMS has the potential to revolutionize debt collection practices and drive the industry forward. As technology continues to advance, debt collectors are recognizing the immense value of combining AI algorithms with SMS communication channels.

The seamless integration of artificial intelligence and SMS brings numerous benefits to debt collection strategies. AI’s ability to analyze vast amounts of data and identify patterns empowers debt collectors to create personalized approaches tailored to individual debtors. By leveraging AI’s insights, debt collectors can develop more effective strategies to engage debtors, increasing the likelihood of successful debt recovery.

Furthermore, SMS acts as the ideal medium for delivering these personalized messages. Its instant and convenient nature ensures that debtors receive important information promptly, leading to quicker responses and action. Debt collectors can leverage SMS to send payment reminders, notifications, or even negotiate repayment plans, all with a high likelihood of being read and acted upon.

The combination of AI and SMS not only enhances the efficiency of debt collection operations but also improves debtor satisfaction. Debtors appreciate the personalized and targeted messaging that AI enables, as it demonstrates that debt collectors understand their individual circumstances and are willing to work with them towards a resolution. The interactive nature of SMS fosters a sense of transparency and trust between debt collectors and debtors, leading to more open communication and a greater willingness on the part of debtors to engage in the debt resolution process.

Moreover, the automation capabilities provided by AI and SMS integration streamline routine tasks, freeing up debt collectors’ time and resources to focus on more complex cases. This improves overall efficiency, enabling debt collection agencies to handle a larger volume of cases effectively.

In conclusion, the future of debt collection lies in the seamless integration of artificial intelligence and SMS. The combination of these powerful technologies offers debt collectors the opportunity to employ data-driven, personalized strategies while leveraging the instant and targeted nature of SMS communication. By embracing this innovative approach, debt collection agencies can improve debt recovery rates, enhance customer experiences, and drive the industry forward into a more efficient and customer-centric future.

Not sure if you’re ready to revolutionize the way your business communicates? Sign up for our 14-day free trial!

What do you have to lose?