What Makes Payment Reminders Valuable

When dealing with a customer who has missed a payment, it’s important to maintain a professional image. Harassing someone who has missed a payment not only shines a negative light on you and your business, but it’s unlikely to get anyone to pay their balance.

While it’s frustrating when a customer hasn’t paid (especially for a small business), maintaining a cool composure and not coming off as pushy will benefit you in the long run.

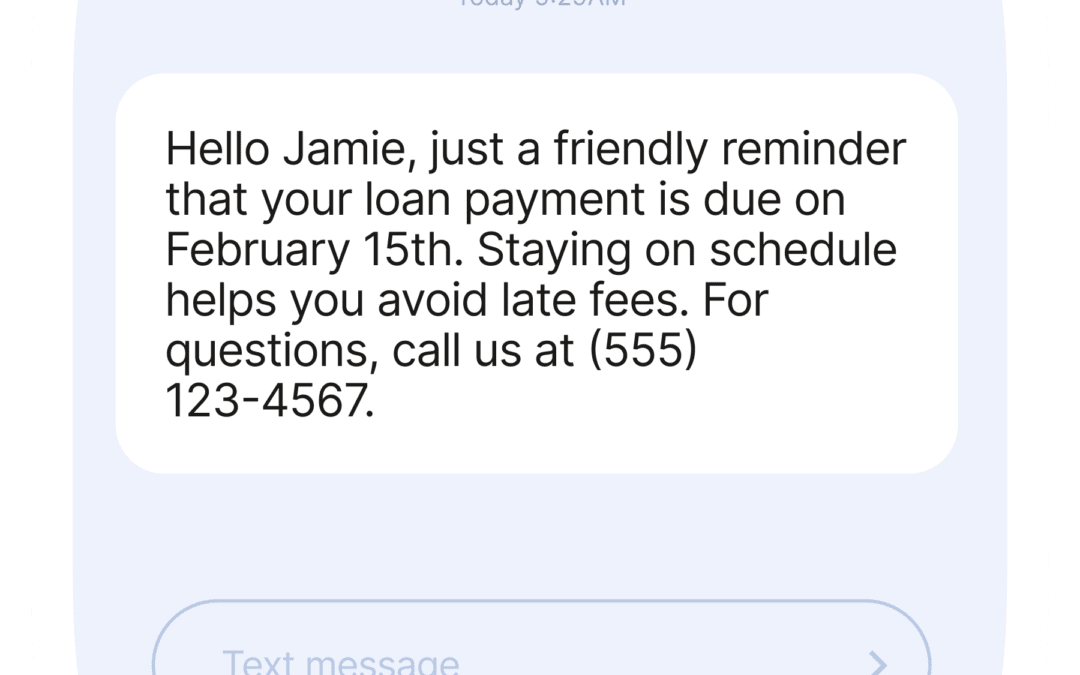

So, here are five templates you can use to request an outstanding payment without sounding pushy:

One-Week Overdue Reminder Template:

Hi, [Client Name]!

This is [Associate Name] with [Company Name].

Payment for Invoice [#] of [invoice amount] is one week overdue.

You can make your payment here: [Link to payment].

If there is anything we can do to assist you in getting this settled, please reach out!

Thank you for your time.

[first name]

One Day Overdue Reminder Template:

Hello [Client Name],

This is [Associate Name] with [Company Name].

According to our records, Invoice [#] is overdue as of yesterday. Currently, there is a balance due of [amount].

I’ve attached the invoice and payment options here [insert invoice link].

If you have any questions or concerns, please reach out to us.

Thank you for your time.

[First name]

Two Weeks Overdue Reminder Template:

Hello, [Name of Client]!

This is [Associate Name] with [Company Name].

I wanted to get in touch with you since my records indicate that the payment of invoice [#] is two weeks overdue.

For your convenience, I’ve included the invoice and payment option here: [link]. Please let me know if there is anything else we can do to help you. A status update would be really appreciated after the payment is made.

Please keep in mind that late penalties will be imposed on any payments that are more than 30 days overdue.

Please don’t hesitate to contact us if you have any questions.

Thank you.

[enter the first name here].

One Month Overdue Reminder Template:

Hello, [Name of Client]

This is [Associate Name] with [Company Name].

We are reaching out to remind you that your payment on invoice [#] is now 30 days overdue as of [Date].

I’ve attached the invoice here [insert link] to make the payment process easy and hassle-free.

Please reach out to us if you have any questions regarding making a payment.

Thank you,

[First Name]

Additional Tips for Putting Together Payment Reminders

• Never sound threatening

• Offer an easy way to pay within your reminder by sending the client a link

• Always offer assistance by inviting clients to reach out to get any questions they may have answered.

• Don’t mention consequences

• Don’t reach out more than once per week. Any more frequent than this is too pushy/ aggressive.

Share Your Message with an SMS Campaign Today!

We make it fast, easy, and affordable to send compliant SMS, Email, and Voice campaigns.

Days Past Due Automated Campaigns: The Set-It-and-Forget-It Approach to Loan Collections

Table of Contents Why Manual Follow-Up Doesn’t Scale Automation Triggers Explained Building DPD Campaigns Message Templates by Stage When to Escalate to Phone Calls Tracking Responses and Payments Compliance Guardrails Getting Started Why Manual Follow-Up Doesn’t...

Auto Loan Text Message Reminders: A Bank’s Guide to Reducing Late Payments

Auto loan delinquency costs banks billions annually. The American Bankers Association reports that delinquency rates fluctuate between 2-4% depending on economic conditions—and every percentage point represents real money walking out the door.

The frustrating part? Most late payments aren’t from borrowers who can’t pay. They’re from borrowers who forgot, got busy, or simply didn’t see the reminder buried in their email inbox.

Text message reminders fix this. Banks using SMS for auto loan payment reminders see 30-40% reductions in delinquency, faster payments, and better borrower relationships. Here’s how to implement them effectively.

How Banks Keep Equipment Finance and Dealer Loans Separate in SMS Campaigns

Banks don’t have one type of loan. They have dozens.

Equipment finance. Dealer floor plans. Auto loans. Commercial real estate. Working capital lines. Each portfolio has different borrowers, different terms, different risk profiles—and different communication needs.

Yet most SMS platforms treat all your borrowers the same. One campaign template. One sending pool. One opt-out list. That’s a problem when your equipment finance team sends a message meant for forklift lessees and it accidentally reaches your dealer network.

Portfolio separation isn’t a nice-to-have. It’s operationally critical.

Equipment Loan Payment Reminders: How SMS Reduces Delinquency by 35%

Late payments cost equipment finance companies millions every year—not just in lost revenue, but in collection costs, strained customer relationships, and administrative overhead. Yet most lenders still rely on the same tired playbook: email reminders that go unread...

What is SMS Chatbot? Benefits, Use Cases & How It Works

When customers want fast answers, text messaging is the most efficient channel. SMS chatbots enable businesses to respond quickly, assist users, and manage repetitive queries without full dependence on human agents. These days most people use text messages, that's why...

How CloudContactAI and an Email Deliverability Expert Improve Your Inbox Reach with AWS SES

In today’s digital world, email deliverability can make or break your communication strategy. Whether you’re running transactional notifications, marketing campaigns, or customer engagement workflows, getting your message to the inbox — not the spam folder — is...

B2B SMS Marketing: The Guide to Business Texting

Emails and calls alone aren't enough for today's businesses. Emails often go unread, calls get ignored, and delays slow down workflow. B2B SMS marketing offers the option of instant and accurate messaging, delivering messages directly and speeding up decision-making....

25 Business Thank You Messages to Show Appreciation

In the world of business, a simple 'thanks' can create a lasting impression. The relationship with customers, partners and supporters deepens by showing appreciation. At one time, a business thank you message proved that you give importance to those who help your...

MMS Marketing: Complete Guide to Boost Engagement

Businesses today face one major challenge—capturing attention in a crowded digital space. Whether it is email, social media or SMS, all have their own importance. But MMS marketing has created a highly effective option for brands that allows them to stand out and be...

SMS vs MMS: What’s the Difference and When to Use Each?

Text messaging is still considered a super strong communication channel for building a direct relationship with customers. Businesses rely on text messaging — everything from sending small reminders to large marketing campaigns. Yet many decision-makers still wonder:...